likelihood of capital gains tax increase in 2021

The proposal would make tax rate in New York on long-term capital gains the same as the rates for income taxes. The proposal calls for increasing the top marginal income tax rate to 396 from 37 the sources said this week.

The Tax Policy Agenda Preparing For Possible Capital Gains Tax Increase 8 3 2021 The Tax Policy Agenda What Businesses Need To Know

It would also nearly double taxes on capital gains to 396 for.

. Activists gather in front of the NYSE as part of a protest calling for an increase in New Yorks capital gains tax on. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is.

The lifetime capital gains exemption is 892218 in. Assume the Federal capital gains tax rate in 2026 becomes 28. Capital gains taxes simply are taxes levied on profits from selling an investment.

For example a single person with a total short-term capital gain of. Likelihood of capital gains tax increase in 2021 Tuesday June 14 2022 Edit. Apr 23 2021 305 AM Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said.

For the taxable year 2022 the top. 2022 federal capital gains tax rates Just like income tax youll pay a tiered tax rate on your capital gains. February 2 2021 737pm.

Capital Gains Tax 101 Selling Stock How Capital Gains Are Taxed The Motley Fool. The Covid-19 crisis has exacerbated the need to raise additional tax revenues and an increase in CGT rates wont break the governments. The measure would impact all capital gains including dividends.

February 2 2021 737pm. President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all sales on or after. Published on 22nd Jan 2021.

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. PoolGetty Images Capital gains tax is likely to rise to near 28 rather. Note that short-term capital gains taxes are even higher.

The current capital gain tax rate for wealthy investors is 20. Various media reports indicate the president will propose taxing capital gains at the top ordinary tax rate which would be 434 when including the current 38 on net. So if you buy 10000 in stock and sell those shares five years later for 20000 you will likely.

The top individual rate would be increased from 37 to 396 and would apply to those with taxable incomes in the top one percent. A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund. The lifetime capital gains exemption LCGE allows people to realize tax-free capital gains if the property disposed of qualifies.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

House Democrats Capital Gains Tax Rates In Each State Tax Foundation

Biden S Tax Plan Would Raise Capital Gains And Eliminate Stepped Up Basis

Short Term And Long Term Capital Gains Tax Rates By Income

Why A Capital Gains Tax Increase Would Be A Massive Jobs And Wealth Killer Foundation For Economic Education

The Irs Taxes Crypto For U S Expats Investments For Expats

Analyzing Biden S New American Families Plan Tax Proposal

Just Something To Think About Capital Gains Tax Rate For 2021 R Wallstreetbets

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Tax Implications Of The 2020 Elections On Agency Sales Agency Brokerage Consultants

State Taxes On Capital Gains Center On Budget And Policy Priorities

Capital Gains Are Sensitive To Taxation Jct Report Tax Foundation

Daniel Clifton On Twitter Despite Wrangling Over A Bipartisan Infrastructure Deal The Betting Odds Of A Corporate Tax Rate Increase Moved Higher Over The Weekend Likely Based Off Manchin S Comments Amp Support

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

2020 2021 Capital Gains Tax Rates And How To Calculate Your Bill

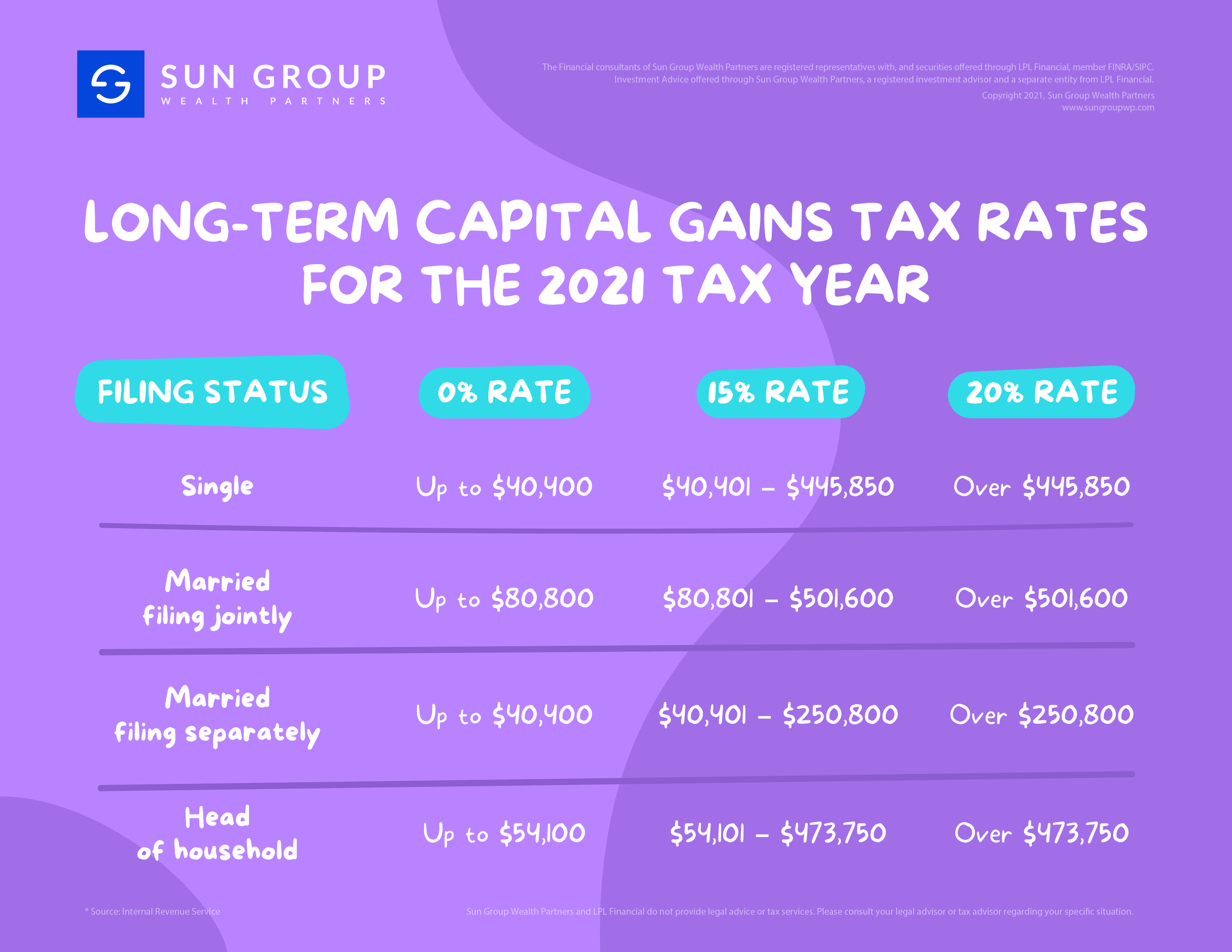

Long Term Capital Gains Tax Rates For The 2021 Tax Year Sun Group Wealth Partners

Long Term Capital Gains Tax Rates In 2021 Darrow Wealth Management

A Probable Capital Gains Tax Rate Increase And The Potential In Opportunity Zones Caliber